Commercial Real Estate - The Impact of Design and Architecture

Design and architecture play a crucial role in shaping the success and value of commercial real estate properties. Beyond mere aesthetics, thoughtful design can enhance functionality, tenant satisfaction, and ultimately, property value. In this comprehensive guide, we will explore the significance of design and architecture in commercial real estate, examining how strategic design decisions can drive tenant attraction, retention, and overall asset performance.

The Role of Design in Property Value

1. Enhancing Tenant Experience

Well-designed commercial properties create a positive experience for tenants, fostering productivity, creativity, and collaboration. Factors such as natural light, efficient floor layouts, and modern amenities contribute to tenant satisfaction and retention, ultimately boosting property value.

2. Differentiating from Competition

In a competitive market, distinctive design elements can set a property apart from its competitors and attract high-quality tenants. Unique architectural features, innovative interior design, and sustainable building practices can enhance a property's marketability and command premium rents.

3. Maximizing Space Utilization

Thoughtful design maximizes the functional use of space, optimizing occupancy levels and revenue potential. Efficient floor plans, flexible layouts, and creative use of common areas can accommodate diverse tenant needs and increase leasing opportunities.

4. Promoting Sustainability

Sustainable design practices not only reduce operating costs and environmental impact but also appeal to environmentally conscious tenants and investors. Green building certifications, energy-efficient systems, and eco-friendly materials enhance the marketability and long-term value of commercial properties.

5. Curating a Strong Brand Image

Design and architecture contribute to the overall brand image and identity of a commercial property. A well-designed building reflects professionalism, quality, and attention to detail, instilling confidence in tenants, investors, and the surrounding community.

Case Studies

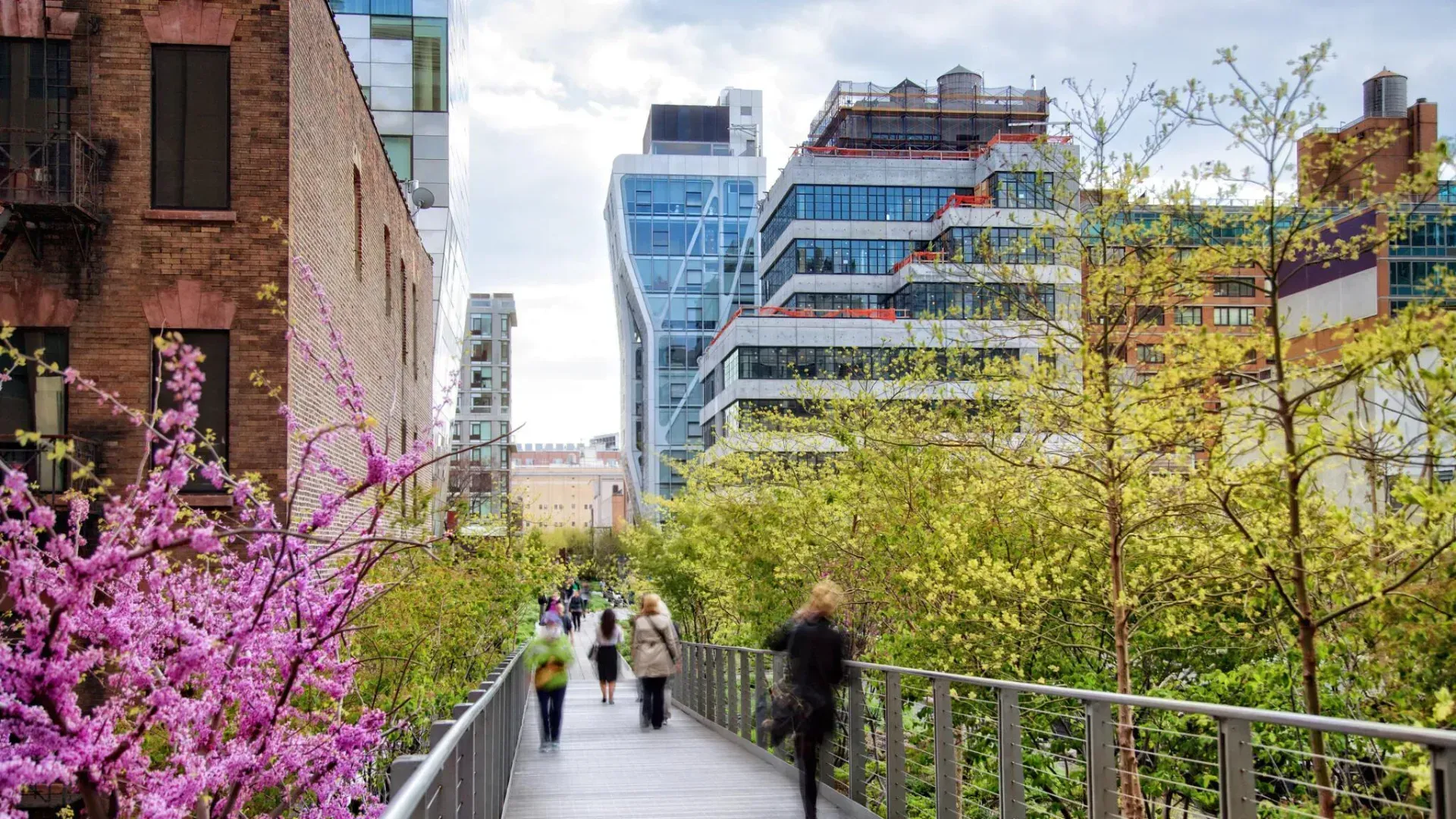

- The High Line in New York City: The adaptive reuse of an elevated railway into a linear park transformed the surrounding area, revitalizing neighborhoods and driving significant increases in property values.

- Apple's Flagship Stores: Apple's retail stores are renowned for their innovative architectural design, creating iconic landmarks that attract customers and drive foot traffic to surrounding properties.

Conclusion

Design and architecture are integral components of successful commercial real estate investments, influencing tenant satisfaction, property performance, and overall value. By prioritizing thoughtful design decisions, property owners and developers can create spaces that not only meet the needs of tenants but also stand out in a competitive market. From enhancing tenant experience to promoting sustainability and fostering brand identity, design plays a multifaceted role in elevating commercial real estate assets and driving long-term value.